Market Value in Crypto – What You Need to Know

When you hear "market value" in the crypto world, think of the total worth of a coin or token at any given moment. It’s basically the price you’d pay if you bought all the coins that are out there. For most of us, that number tells us if a crypto is hot or not, and it helps decide whether to jump in or stay away.

Why does it matter? A higher market value usually means more people trust the project, but it can also hide risk. Low market value can signal a hidden gem—or a crypto that’s about to disappear. In Africa, where access to traditional banking is still limited, these signals are especially important for everyday investors.

How to Track Market Value Daily

First, pick a reliable price tracker. Sites like CoinGecko or CoinMarketCap give you real‑time numbers for thousands of tokens. Open the app, type the coin’s name, and you’ll see its market cap, circulating supply, and price changes over 24 hours, 7 days, and a month.

Second, set up alerts. Most trackers let you create push notifications for big moves (say, a 10% jump). That way you don’t have to stare at the screen all day, but you’ll catch the big swings that matter.

Third, watch the volume. A coin can have a huge market cap but low trading volume, meaning it’s hard to buy or sell without moving the price. High volume with a solid market cap usually means the market is liquid and the price is more reliable.

What Market Value Means for African Investors

In many African countries, the local currency can lose value quickly. Holding crypto with a strong market value can protect your savings from inflation. However, you also need to consider exchange fees and the ease of converting crypto back into cash.

Local exchanges like Luno, VALR, and Paxful often list the biggest coins with the most transparent market values. When you trade, compare the price on the exchange with the global market cap to make sure you’re not paying a hidden premium.

Finally, think about diversification. Don’t put all your money into one coin just because its market value looks impressive. Spread your investment across a few top‑cap coins and a handful of smaller projects that have real use cases in Africa—like payments, remittances, or agricultural tech.

Bottom line: market value is a quick snapshot of a crypto’s size and popularity, but it’s only useful when you pair it with volume, liquidity, and local market conditions. Keep an eye on the numbers, set alerts, and stay honest about the risks. That’s how you turn market value into a practical tool for building wealth in the African crypto space.

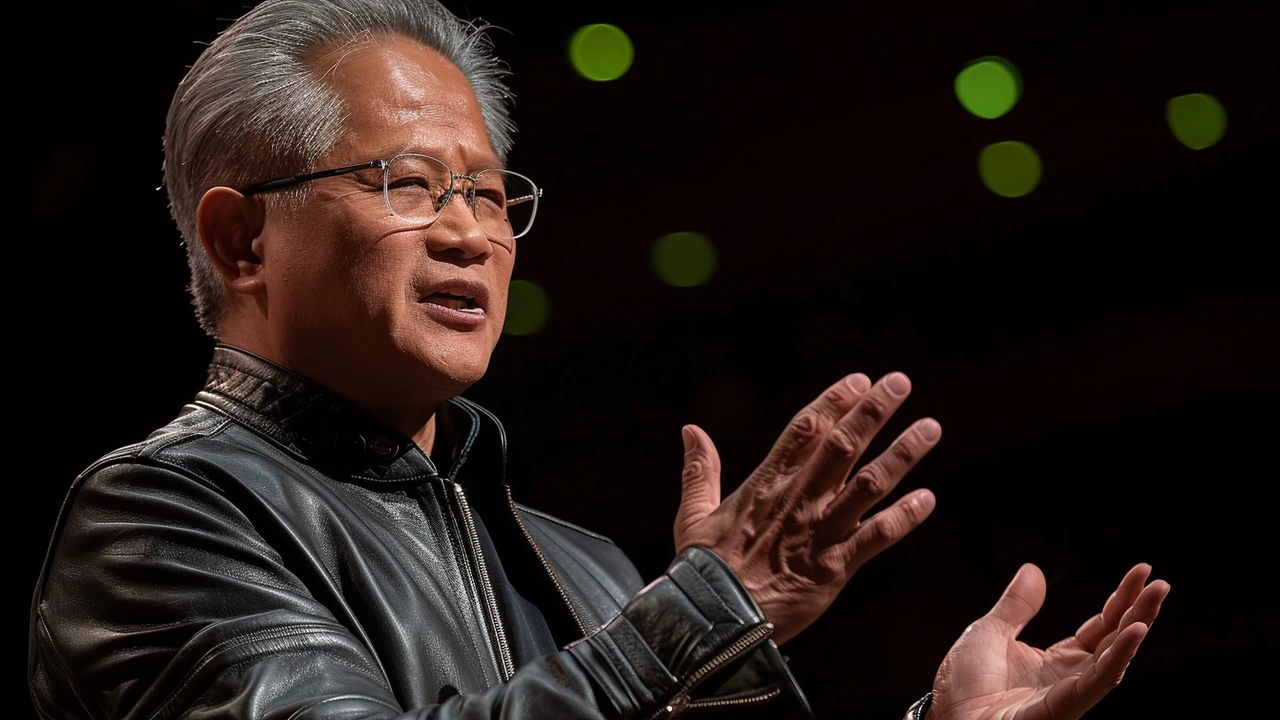

Nvidia Soars: The Rise to Becoming World's Most Valuable Company Amid AI Boom

Nvidia has achieved a remarkable milestone by becoming the world's most valuable company, driven by a significant increase in its stock price. This surge has seen Nvidia's market value surpass that of Microsoft, Apple, and other tech giants. The company's success is largely attributed to its pivotal role in the AI chip market. Despite some investor concerns, the overall sentiment remains optimistic about Nvidia's future growth.