AI Chips: Boosting Crypto Mining and Tech Innovation in Africa

When you hear "AI chip," think of a tiny super‑engine that can crunch data way faster than a regular CPU. These chips are built for machine learning, but they also shine in crypto mining, data centers, and even smartphones. In Africa, where mobile connectivity and renewable power are on the rise, AI chips are opening new doors for startups and miners alike.

Unlike traditional processors, AI chips use parallel cores, specialized matrix math units, and low‑latency memory to handle massive tensor calculations. That means they can train a language model or solve a mining hash in a fraction of the time – and with less energy. Energy efficiency matters a lot on the continent, where power costs can eat into profits.

What Makes an AI Chip Different?

First off, AI chips are designed for specific tasks. NVIDIA’s H100, AMD’s Instinct MI250, and Google’s TPU all have hardware that speeds up matrix multiplication – the backbone of neural networks. These chips also support mixed‑precision computing, letting them switch between 16‑bit and 32‑bit numbers on the fly. The result? Faster processing with lower electricity use.

Second, many AI chips come with built‑in security features. For crypto miners, that means protection against tampering and a more reliable hash rate. Some newer models even integrate on‑chip encryption, which is handy for fintech apps that need to keep data safe.

Why AI Chips Matter for Crypto Mining and Finance

Crypto mining is all about solving complex math problems quickly. Traditional GPUs can do the job, but AI accelerators often beat them on speed‑per‑watt. A miner using an H100 can generate more hashes while sipping less power, translating into lower operating costs and a smaller carbon footprint – a win for both profit and sustainability.

Beyond mining, AI chips help banks and fintech firms run fraud detection, credit scoring, and real‑time transaction monitoring. The same parallel processing that speeds up a neural net also speeds up large‑scale data analysis. For African startups that need to process millions of mobile payment logs each day, AI hardware can be the difference between a laggy service and a smooth user experience.

Local companies are already testing these chips. A Nairobi‑based AI lab recently partnered with a data‑center provider to trial AMD Instinct GPUs for both climate‑model simulations and blockchain analytics. Early results show a 30% reduction in energy use compared to older GPU rigs.

If you’re a miner or a fintech developer, here are three practical steps to get started with AI chips:

- Identify the workload. If you’re training models or mining, look for chips that excel at tensor operations. For general‑purpose data crunching, a versatile GPU like the NVIDIA RTX series may suffice.

- Check power and cooling. AI chips can run hot. Make sure your rack or mining rig has adequate cooling – many African data centers now use solar‑powered cooling towers.

- Leverage cloud options. If buying hardware is too pricey, cloud providers such as AWS, Azure, and Google Cloud offer AI‑accelerated instances. You can scale up during peak mining seasons and scale down when prices dip.

In short, AI chips are reshaping how we process data, mine crypto, and run financial services across Africa. By choosing the right hardware and pairing it with smart energy solutions, businesses can stay ahead of the curve while keeping costs in check.

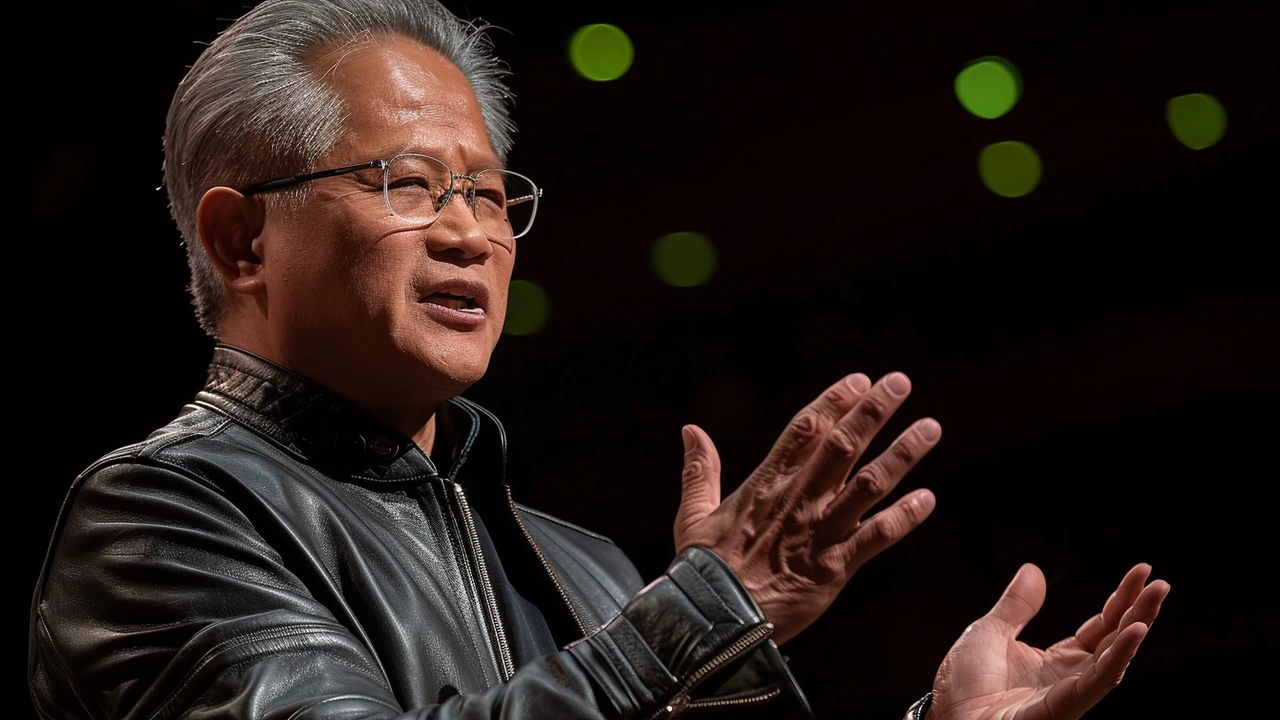

Nvidia Soars: The Rise to Becoming World's Most Valuable Company Amid AI Boom

Nvidia has achieved a remarkable milestone by becoming the world's most valuable company, driven by a significant increase in its stock price. This surge has seen Nvidia's market value surpass that of Microsoft, Apple, and other tech giants. The company's success is largely attributed to its pivotal role in the AI chip market. Despite some investor concerns, the overall sentiment remains optimistic about Nvidia's future growth.