Nyota: Africa’s Emerging Blockchain Star

When you hear Nyota, a Swahili‑named blockchain platform that aims to bridge mobile money and crypto markets across Africa. Also known as NyotaPay, it blends low‑cost transactions with on‑chain transparency, targeting unbanked users who rely on mobile wallets.

Nyota isn’t a stand‑alone product; it sits inside a broader blockchain, a decentralized ledger technology that records every transaction without a central authority that powers many African fintech solutions. The platform leverages smart contracts to automate payouts, which means businesses can trust that funds move exactly as programmed. Because the ledger is public, regulators can audit activity without exposing user privacy.

How Nyota Connects to Digital Wallets and Fintech

One of Nyota’s biggest strengths is its seamless link to digital wallets, mobile apps that store fiat and crypto balances, enable peer‑to‑peer payments, and support QR‑code transactions. Users in Kenya, Nigeria, and South Africa can top up a wallet with local currency, then instantly swap to Nyota’s native token for cross‑border transfers. This reduces the friction that traditional banks impose, especially for small‑scale traders who move money daily.

Fintech firms that build on Nyota gain access to a ready‑made compliance layer. The platform incorporates know‑your‑customer (KYC) checks, AML monitoring, and transaction limits that meet regional guidelines. For a startup, that’s a huge time‑saver—no need to reinvent the compliance stack from scratch.

Nyota also taps into the growing cryptocurrency, digital assets that can be transferred without intermediaries and often serve as a store of value ecosystem. By offering an easy on‑ramp from local fiat to crypto, Nyota helps users hedge against inflation and gain exposure to global markets. The platform’s token is designed for low volatility, making it more appealing for everyday purchases.

So how do all these pieces fit together? Think of Nyota as the hub in a network where blockchain provides the backbone, digital wallets act as the user interface, fintech companies add business logic, and cryptocurrency supplies the asset class. In semantic terms, Nyota encompasses blockchain, requires digital wallets, and enables fintech innovation. The result is a smoother flow of money across borders, faster settlement times, and lower fees for merchants and consumers alike.

Looking ahead, Nyota’s roadmap includes integrating with regional mobile money operators, expanding token utility for bill payments, and launching a developer portal for custom dApps. Those moves will deepen its footprint in the African crypto landscape and give more entrepreneurs the tools to build services that matter—like micro‑loans, remittances, and supply‑chain tracking.

Below you’ll find a hand‑picked set of articles that dive deeper into Nyota’s technology, its impact on African fintech, and real‑world use cases. Whether you’re a developer, investor, or casual reader, the collection offers practical insights that show why Nyota matters right now.

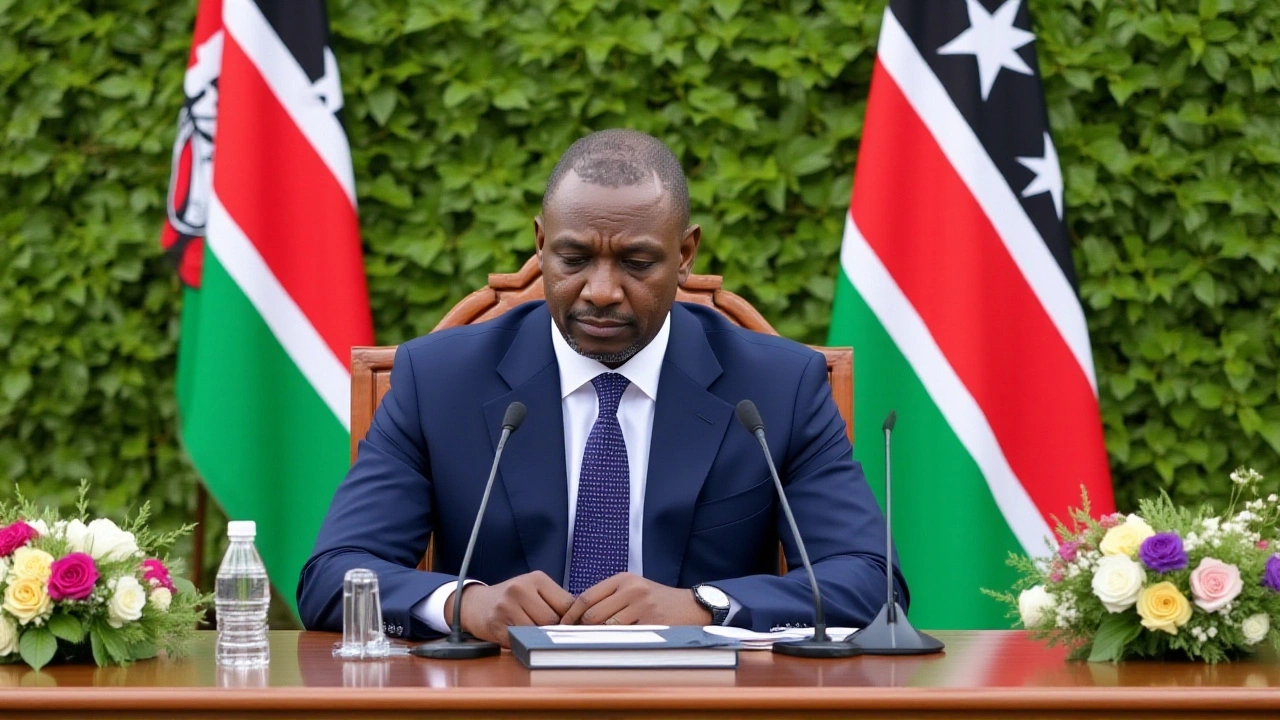

Kenya Launches KSh20 Billion NYOTA Program to Transform 820,000 Youth

Kenya's NYOTA program, backed by the World Bank and announced by President William Ruto, will invest KSh20 billion to empower 820,000 vulnerable youth through grants, training and savings incentives.